Why LIC Life Insurance Policies and Pension Plans Remain Best-Selling in India

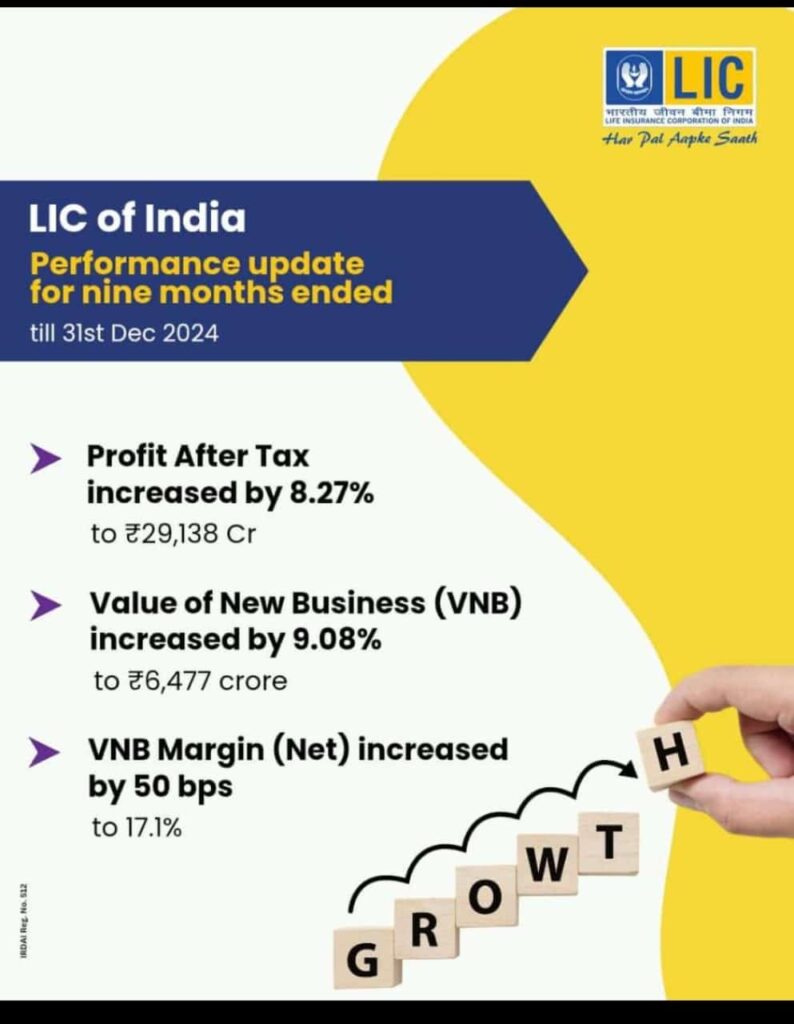

The Life Insurance Corporation of India (LIC) has long been a dominant force in the Indian insurance industry. Despite the emergence of numerous private insurers along with public sector banks such as SBI coming into the foray, LIC’s life insurance policies and pension plans continue to be the best-selling products.

Even insurance concepts such as Unit Linked Insurance Policies (ULIP) have LIC outperforming the competition. Have a look at this PDF illustrating the financials of LIC Vs other popular ULIP offerings in the market by clicking here.

Here are some reasons why:

- Trust and Reliability

LIC has been in operation for over 60 years, establishing itself as a trusted name in the insurance sector. Its long-standing reputation for reliability and financial stability makes it a preferred choice for many Indians. - Comprehensive Coverage

LIC offers a wide range of insurance products, including endowment plans, whole life plans, money-back plans, term assurance plans, and pension plans. This variety ensures that there is a suitable policy for every individual’s needs, making it easier for customers to find the right coverage. - Sovereign Guarantee; Government Backing

As a government-owned corporation, LIC enjoys implicit support from the government, which adds to its credibility and assurance of policyholder protection. This backing provides a sense of security to policyholders, knowing that their investments are backed by national governing entity. - Tax Benefits

LIC’s insurance policies and pension plans offer attractive tax benefits under Section 80C and 80CCC of the Income Tax Act. Policyholders can claim deductions up to INR 1.5 lakhs, making these plans financially appealing. - Pension Plans for Retirement Security

LIC’s pension plans are specifically designed to provide financial security during retirement. These plans help individuals create a retirement corpus and ensure a steady income post-retirement. With options like deferred annuity plans and immediate annuity plans, LIC caters to different retirement needs. - Customer Service and Accessibility

LIC has a vast network of branches and agents across India, making it easily accessible to customers. The company also offers various online services, ensuring convenience for policyholders. - Competitive Returns

LIC’s unit-linked insurance plans (ULIPs) offer market-linked returns, allowing policyholders to potentially earn higher returns on their investments. This feature is particularly attractive to those looking to grow their wealth over time. - Flexibility

LIC enables customers to have partial withdrawals to continue receiving benefits of life coverage or pension without surrendering or terminating their policy. Customers may even take a loan as per need to avoid loss of insurance coverage and pension when customers ponder surrendering policy to source liquid funds. - Benefits to Married Women and Children

Married Women and Children benefit greatly from policies, plans and schemes made by Indians for Indians at LIC. Do enquire about Married Women’s Property Act with us if you are ever in doubt about legalities of nominees Vs creditors. We often offer consultancy for free. - Purpose to be of Service

LIC advices as per needs of customer. The plans and the company itself exists for the benefit of India’s citizens as a government backed entity. It doles out maximum possible benefits to each customer irrespective of their background or status.

In conclusion, LIC’s combination of trust, comprehensive coverage, government backing, tax benefits, retirement security, customer service, and competitive returns makes its life insurance policies, pension plans, ULIPs, the best-selling products in the Indian insurance industry. These factors have shown consistency for decades and they continue to remain strong. LIC rightfully stays dominance in the insurance and financial products market.